#FAKE BANK STATEMENT SOFTWARE#

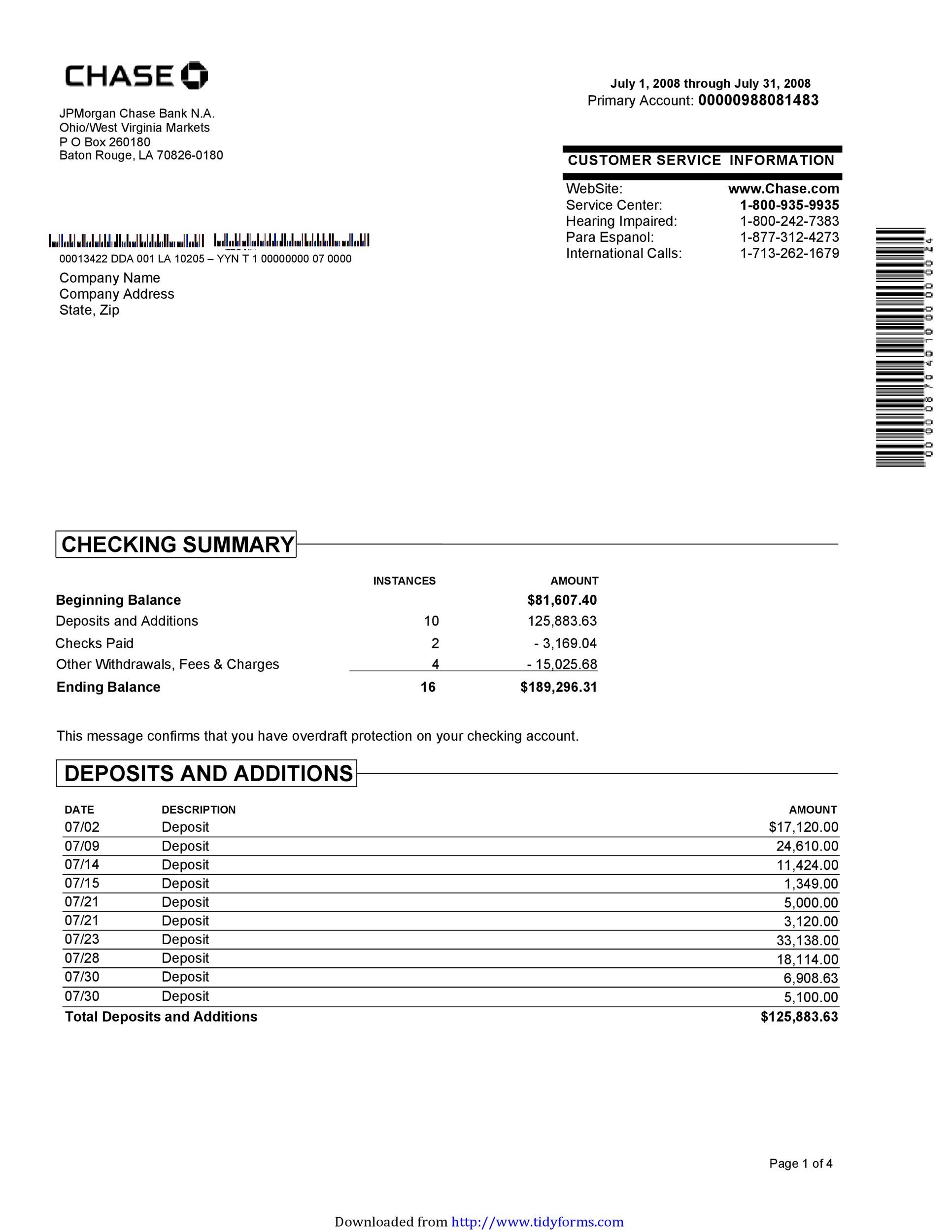

Inscribe’s software is night vision goggles for your fraud team. With Inscribe, you’ll receive an analysis in 10 seconds, of the metadata, pixel level information, and file history of a document. We’re just scratching the surface on the advantages software has in analyzing the legitimacy of documents when compared to the human eye. It’s unrealistic for a fraud analyst to memorize all the metadata properties expected for an individual bank statement yet alone the statement properties for the thousands of different banks your applicants use. They should be able to tell you the font style, font size, latest logo placement, the expected URL, the expected document author, and the alignment of name/address within the top left corner of the document. So how do you combat the rampant use of entirely fake, online purchased financial documents? The new way of detecting document fraudĪsk your best fraud analyst what properties should be contained in the latest version of a Bank of America personal checking bank statement. The human eye cannot reliably identify manipulation in these documents. Problems with the old wayĪ quick Google search will result in hundreds of websites where a fraudster can buy a fake financial document. Well trained analysts can conduct a thorough investigation of an individual document in 5-10 minutes. The old way of detecting document fraud is limited to the human eye and metadata property analysis.

#FAKE BANK STATEMENT PDF#

Further, a well trained, experienced fraud analyst will review the metadata properties of a document looking for suspicious traces of manipulation such as PDF editing software like Photoshop or an untrusted document author. The human eye can spot obvious inconsistencies in text style, spacing, alignment, and color. The old way of identifying document manipulation is using the human eye. How do you identify fake loan documents? The old way of detecting document fraud Document manipulation is highly correlated with loan write-offs. Further, our research suggests that a fraudulent application document leads to a loan write off rate of 60% on average. Our data shows that 5% of all financial application documents submitted in an online channel have been manipulated. Today’s online lenders ask applicants to upload bank statements, pay stubs, tax forms, and other financial documents to assess creditworthiness.

0 kommentar(er)

0 kommentar(er)